Chinese startups and their investors are facing significant challenges from constant COVID lockdowns and a slowing economy. During these uncertain times, founders must adapt fast in order to survive and thrive. Eminence shares the following six recommendations with our founders.

The 2nd annual Eminence Ventures CEO Summit took place in Shanghai on Feb 19 when our portfolio company CEOs gathered to learn best practices, share views, celebrate our achievements, and discuss the latest trends, challenges, and opportunities for the enterprise cloud market.

A Harvard University-educated designer has turned his content marketing platform into a unicorn, helped by investors betting on enterprise software as the next big opportunity in China’s tech industry.

Tezign, which connects designers with businesses, completed the first tranche of its Series D round led by Temasek Holdings Pte, boosting its valuation to more than $1 billion, the startup said. It received about $40 million from the Singaporean state investment firm and other backers.

eSign, a Chinese provider of electronic signature services backed by investors including Ant Group, has closed a Series E funding round at 1.2 billion yuan ($186.1 million). The investment was jointly led by Sequoia Capital China, IDG Capital and Hidden Hill Capital, a private equity investment platform backed by Asia's warehouse operator GLP.About Us

Hunting Enterprise Cloud Unicorns in China

Eminence Ventures was founded in 2017 and currently manages dual-currency (USD and RMB) funds with hundreds of millions of dollars under management. Our investors include U.S. endowment funds, fund-of-funds, family offices, individual founders, and executives from top-tier technology companies. As an exclusive strategic partner of Emergence Capital, a well-known Silicon Valley VC focused on enterprise cloud, we are uniquely positioned to provide value to our portfolio companies.

Our team has extensive experience in the B2B sector and a deep knowledge of and network within the industry. We are committed to early-stage investments in China's enterprise software and cloud computing (enterprise cloud) with a focus on exceptional entrepreneurs who are using technologies such as AI, big data, cloud, industry digitization and Fintech to disrupt their industries or enable enterprises to win.

Our mission is to become the most important VC partner for the best entrepreneurs in China's enterprise cloud market. We are long-term investors who recognize the potential of visionary founders and seek to support them in building successful businesses that will transform industries.

Team

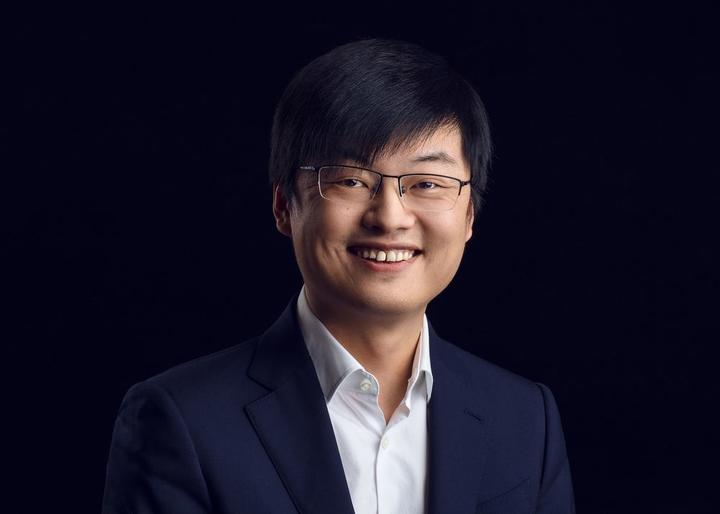

Peter Cheng

Founding Managing Partner

Peter is a serial entrepreneur and seasoned executive who had worked for three startups and four Fortune 500 companies. Prior to his venture capital career, Peter was the General Manager of Advertising Platform & Products at Tencent, and a Tencent Outstanding GM Award winner. He was also the co-founder, COO, Board member and an angel investor of AdChina, the leading digital advertising platform that was acquired by Alibaba. Prior to founding AdChina, he was VP of Product Management at Adify, a Silicon Valley advertising infrastructure startup that enabled entrepreneurs and media companies to build vertical ad networks and was acquired by Cox for $300 million. Peter held senior management positions at eBay, including Head of Product responsible for eBay’s global Internet marketing products and initiatives. Before joining eBay, Peter served as a group product manager at Vividence (acquired by Keynote Systems and then Dynatrace). Peter started his career at FedEx as a senior marketing analyst and then joined Oracle as a product manager building its ERP and CRM applications. Peter holds a Bachelor of Science degree in Computer Engineering from Jiao Tong University and an MBA degree from the Kelley School of Business at Indiana University.

Simon He

Founding Partner

Simon is responsible for Eminence's vertical SaaS & B2B marketplace investments. He started his venture capital career at Integral as Vice President, focusing on B2B marketplace and enterprise cloud investments. Prior to Integral, Simon was the Head of Programmatic Buying at Tencent Advertising Platform & Products. Simon was a founding member and General Manager of Media Platform at AdChina (acquired by Alibaba). Earlier in his career, Simon was with SNDA (China's biggest online games operator) as a senior product manager. Simon has a M.S. degree in Software Engineering from Fudan University and also a B.S. degree in Business Administration from Huazhong University of Science & Technology.

Jack Ren

Partner

Jack is responsible for Eminence's Cloud & IT Infrastructure investments. Prior to Eminence, Jack worked at Cisco's Corporate Development team responsible for its strategic investments in China. Jack was also the lead project manager spearheading China Mobile's OneNET IoT Open Platform, which has been the world's largest IoT open platform. Earlier in his career, Jack worked at Samsung in Suwon, Korea as a software development manager launching Samsung's first Chinese Android-based Galaxy smartphones. Prior to Samsung, Jack worked at Sony in Tokyo, Japan as a senior engineer. Jack holds an MBA from Yale University and a Ph.D. degree in EE from Tsinghua University.

Laven Luo

Partner

Laven is responsible for software international expansion, cross-border e-commerce, industry digitalization, and enterprise fintech investments. He has over 8 years of experience in the VC investment. He participated in and led the investment in Duckbill, Liga.AI, and Naturobot. He has rich investment experience in industry digitization, software globalization, and cross-border fields.

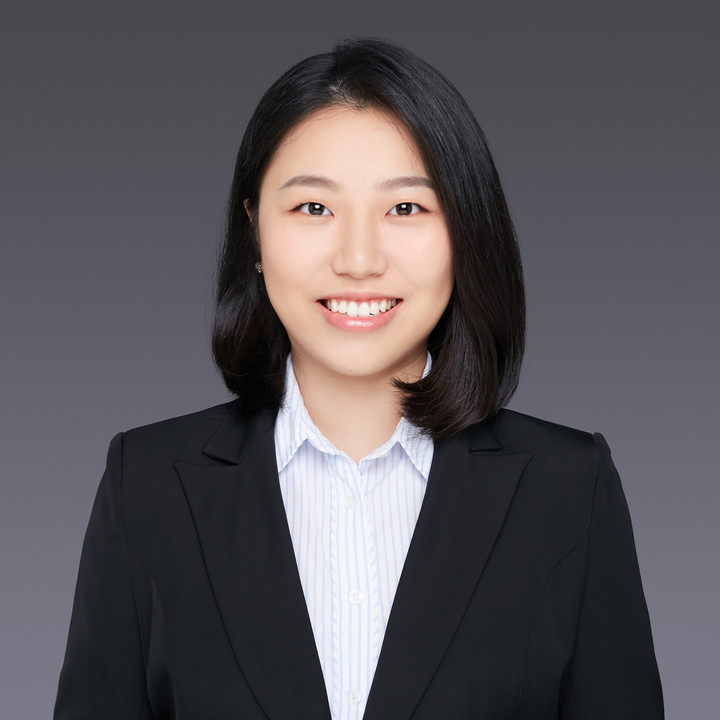

Joy Dai

Senior Investment Director

Joy is responsible for Eminence's horizontal SaaS and PaaS investments. Prior to Eminence, Joy worked as an analyst at Morgan Stanley and was later with an insurance asset management firm, building up her in-depth knowledge in the areas of finance, insurance and wealth management. Joy holds a Bachelor of Finance degree from Shanghai JiaoTong University.

Leo Hu

Investment Director

Leo is responsible for Eminence's IT Infrastructure investments. Before joining Eminence, Leo Hu was an Investment Manager at M31 Capital. He focused on enterprise cloud, new energy, and smart manufacturing investments. He participated in and led the investment in Sensors Data and Kafang Technology. Before M31 Capital, he was an analyst of Giant Network(SHE:002558). Leo graduated from Peking University with a BS degree in Engineering, and from Carnegie Mellon University with an MS degree in Engineering Informatics.

Veron Wang

Investment Manager

Veron holds a Bachelor's degree from Renmin University of China, and studied at Waseda University. Prior to joining Eminence Ventures, he was an investment manager at Pegasus Group, focused on early incubation and investment in entertainment and consumption fields.

Jason Liu

Investment Manager

Jason is responsible for Eminence'scross-border, e-commerce SaaS, Fintech, and Artificial Intelligence investments. Before joining Eminence, Jason Liu was an analyst in the China-Europe cross-border M&A department of DealGlobe, the leading advisor and investor focused on China cross-border deals. He also accumulated investment experience at Warburg Pincus and Loyal Valley Capital. He graduated from the University of California, Los Angeles.

Emma Wang

VP of Marketing and Public Relations

Emma is responsible for Eminence's marketing and brand building. Prior to joining Eminence Ventures, Emma worked as a senior marketing director at Gopher Asset Management of Noah Holdings (NYSE: NOAH). Before Gopher Asset, she worked in the famous public relations firms, Ruder Finn and Fleishman Hillard, and was later with PingAn Leasing as the brand director. Emma holds a Master of Journalism and Communication degree in Journalism and Communication from Fudan University and a Bachelor of Life Sciences degree from Nankai University.

Rachel Zou

Senior Finance Director

Rachel is responsible for fund finance/accounting, compliance and post-investment management. Before joining Eminence Ventures, Rachel worked in PwC as an audit manager and had more than 7 years' experience in fund audit. Rachel is a CPA and CFA holder. She holds a Bachelor and a Master degree of Biomedical Engineering from Shanghai Jiaotong University.

Eileen Lin

Finance Director

Elieen is responsible for fund finance/accounting, compliance and post-investment management. Prior to joining Eminence Ventures, Elieen worked as a senior auditor at Marcum Bernstein & Pinchuk LLP (Shanghai office), she has extensive experiences in auditing for IPO in the US stock market. Elieen holds a Bachelor of Accounting degree from Zhongnan University of Economics and Law and a Master of Finance degree from the University of Melbourne.

Angela Ma

Senior Operations Manager

Angela is responsible for Eminence's fund operation and supports investor relations. Prior to joining Eminence Ventures, Angela worked as the Executive Assistant at PureTerra Ventures. She holds a Master of Science degree from Duquesne University and is an MBA candidate at the University of Alberta.

Portfolio

Horizontal SaaS

The leading B2B marketing cloud with full WeChat integration

The largest electronic signature and intelligent contract management platform in China

Related Press:

TechinAsia: Ant Group-backed e-signature provider bags $151m in series D round

Deal Street Asia: Ant Group-backed Chinese e-signature service eSign nets $150m Series D

A leading CRM for membership and event management

Related Press:

PR Newswire: Glue Up delivers more value to clients with speed networking

TSNN: New tech tools help planners along each stage of an event

China’s Airtable, a no-code productivity and collaboration SaaS company

Customer Success Platform to Grow Business

Related Press:

Pandaily: Customer Success Platform Hokdo Completes Pre-A Round of Financing

An IT R&D project management SaaS for software team to plan, track, and ship software

Vertical SaaS

A cloud-based ERP and B2B eCommerce platform for CPG (consumer packaged goods) distributors and wholesalers

The leading digital marketplace for shippers and cargo container trucks

Related Press:

Deal Street Asia: Temasek leads $50m funding in Chinese container truck fleet operator Duckbill

KrAsia: Duckbill's digital freight-matching platform offers stability in a chaotic logistics industry: inside China's startups

AI-powered CRM for the real estate industry

The collaborative and interactive design tool

A fintech company that provides comprehensive solutions for cross-border payments for global merchants

Leading B2B "buy now, pay later" cross-border digital financing solution provider

AI

A creative cloud and marketplace connecting designers with brands and eCommerce operators

Related Press:

Tech in Asia: Temasek, SoftBank invest in Sequoia-backed Chinese marketing solutions startup

AI-powered in-store retail execution and audit solutions that turns everyday shelf images into real-time actionable insights

AI-powered conversation intelligence based on NLP

Related Press:

Deal Street Asia: China deal monitor: Sequoia leads $12m funding in Recurrent AI and more

Video tool products powered by AI algorithm engines

A low-code vendor with a one-stop AI application development collaboration platform

IT Infrastructure

Naturobot's core RPA product provides a combination of iPaaS and cloud native deployment

Next generation vector search engine and AI database built upon NVIDIA's GPU

Related Press:

TechCrunch: Zilliz raises $43million as investors rush to China's open-source sofware

Software-defined storage built for the cloud

Related Press:

Holo Base: Chinese firm YanRong Tech bags a $19 million funding in its Series A+

An integrated solution for office security based on the concept of zero trust and SASE architecture

Past Portfolio

Leading integrated digital advertising platform in China

Status: exited, acquired by Alibaba in 2015

EECI Index

Although Chinese enterprise cloud is still in its infancy stage, it has already begun to enter rapid development phase. For tracking the performance of Chinese enterprise cloud and providing a market benchmark, Eminence Ventures, the leading venture capital firm laser-focused on early-stage Chinese enterprise companies, designed and published this EECI Index.

- Press

Announcing the First Close of Our RMB Fund II

Welcoming Two Senior Members to Team Eminence

Views | Shrink to Win: Shrink to Win: How SaaS Companies Survive a Recession and Thrive Afterward?

CEOs Gather in Shanghai for Eminence Ventures CEO Summit 2022

Honor | Eminence Ventures Receives Two Top Honors by Chinese Ventures

Portfolio | Temasek leads $50m funding in Chinese container truck fleet operator Duckbill

Portfolio | Chinese firm YanRong Tech bags a $19 million funding in its Series A+

Portfolio | Tezign and Duckbill listed in 'The 50 Most Promising Startups' by The Information

Portfolio | Ant Group-backed e-signature provider bags $151m in series D round

Portfolio | Glue Up delivers more value to clients with speed networking

Portfolio | Chinese Logistics Startup Duckbill Snags US$30M In Pre-Series B Round

Portfolio | China Digest: Sequoia leads Tezign's Series C1

Portfolio | China deal monitor: Sequoia leads $12m funding in Recurrent AI and more

Portfolio | Zilliz raises $43million as investors rush to China's open-source software

Contact Us

Eminence Ventures

Address: Suite 503, Building 16, 1036 Tianlin Rd, Minhang District, Shanghai

Email us

hello@emventures.cn